|

A stock thesis that I've continued to stay positive on, throughout the past couple of years. Stock performance hasn't been great but update on notes:

0 Comments

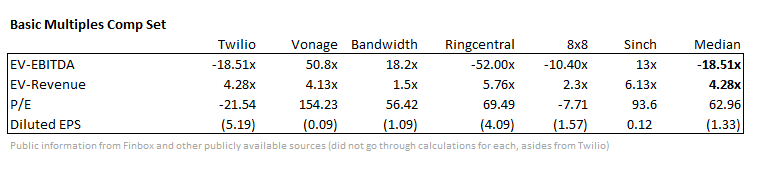

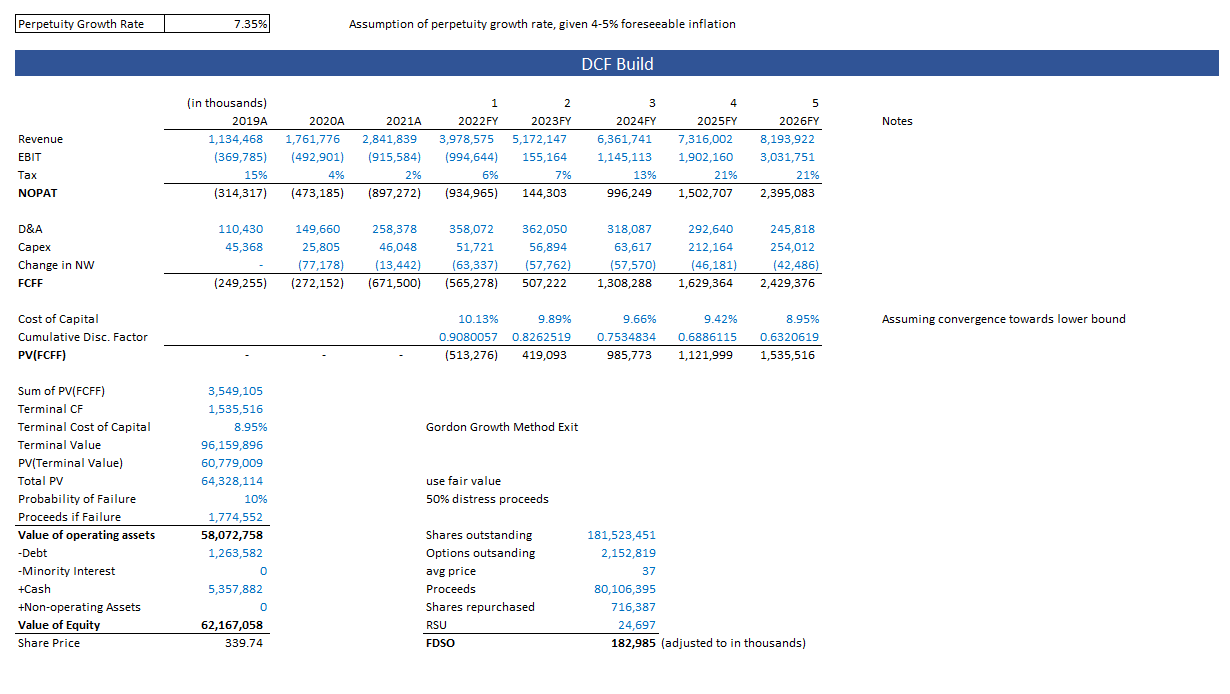

Situated in the CPAAS (communications platforms as a service), Twilio is one of the largest key player within the space. With an overall industry 27.6% CAGR, which translates to tripling in sizing within the next few years, Twilio currently holds 38% of TAM. Global mobile app markets and cloud communications are both poised to meaningfully grow as well (with mid 20% CAGRs) - companies such as Airbnb, Lyft, etc., also happen to be clients of Twilio. Closest competitors currently are Vonage and Sinch (Sweden). Twilio operates via a cloud-based delivery model that enables users to add video, messaging and voice features to business software. It recently launched Twilio Engage, which is the by-product of its channel APIs and Segment's customer data platform. High switching costs, technology and network effect allows them to continue a foothold in the market. Despite EBITDA being negative, they have a huge 5.9 billion cash balance and 1 billion in debt, so given their revenue growth at around 40%, which outperformed what leadership said to be 30%, it has great potential. As active customer accounts continue increasing, there is a large amount of growth expected in the near term, as their business stabilizes/potentially breaks even. From a pricing perspective, enterprise value multiples show attractive relative pricing to its competitors. Although leverage structures differ largely across peers in this space, an intrinsic valuation still shows large upsides of more than 300% for Twilio within the next few years - assuming a slowdown in revenue growth from 40% in 2022 to 12% by 2026. With a perpetuity growth rate assumption of 7.35% at terminal value, intrinsic share price is valued to be $339.74. Employing an EV/EBITDA exit of a conservative 15x (relative to Vonage and Sinch), implied trading value range also shows a 200%+ upside. Rating: Buy (OW)

A privately-held Irish-American fintech software company (full payments stack) founded by Patrick and John Collison focused on payment processing and APIs for businesses. This payments infrastructure is widely used, notably by tech giants such as Amazon, Instacart, Shopify, Zoom, etc. Out of the tech companies that went public in 2021, 60% of them were Stripe customers. It operates with the principle “Users First” to provide efficient solutions for businesses to calculate revenue, make payroll, file taxes, pay suppliers, etc. Powers 135 currencies. Primarily in the payments space, but partnered with other SaaS platforms like Lightspeed, can offer very comprehensive 1-stop solutions.

Business basics + Statistics:

Competitive advantages:

Valuation: In comparison to other firms such as: Adyen ‘21 GPV: $561B + 70% YoY (2180 employees)

Compared to competitors such as Square/Block, pricing is slightly more expensive in some aspects; however, it is a more comprehensive e-commerce platform solution. Square/Block is primarily focused on SMBs who sell primarily in person, while Stripe is more for e-commerce. Relative to Adyen, it has more integration partnerships (i.e. with Shopify, etc.) and has more support options for businesses; it also is more flexible for individuals while Adyen requires an application for all business accounts to receive a merchant account. With a slightly different consumer base focus and a powerful international merchant platform (alongside advanced reporting tools), Stripe is quite differentiated in its field. It has a large growing consumer base and higher margins than its closest peers. |

|||||||